Tindeco Investment Studio

Investment solution factory from design through implementation

Investment solution factory from design through implementation

Tindeco Investment Studio lets you select and customize systematic investment strategies. These strategies can run portfolios on an automated basis according to the desired workflows.

New strategies can be designed in minutes using the no-code interface which allows you to connect data, algorithms, and logic from Tindeco and its partners.

Tindeco provides everything you need to design, test, implement and distribute virtually any systematic investment solution: multi-asset class and multi-strategy, including derivatives.

A new way to manage money…

Use systematic strategies to manage portfolios

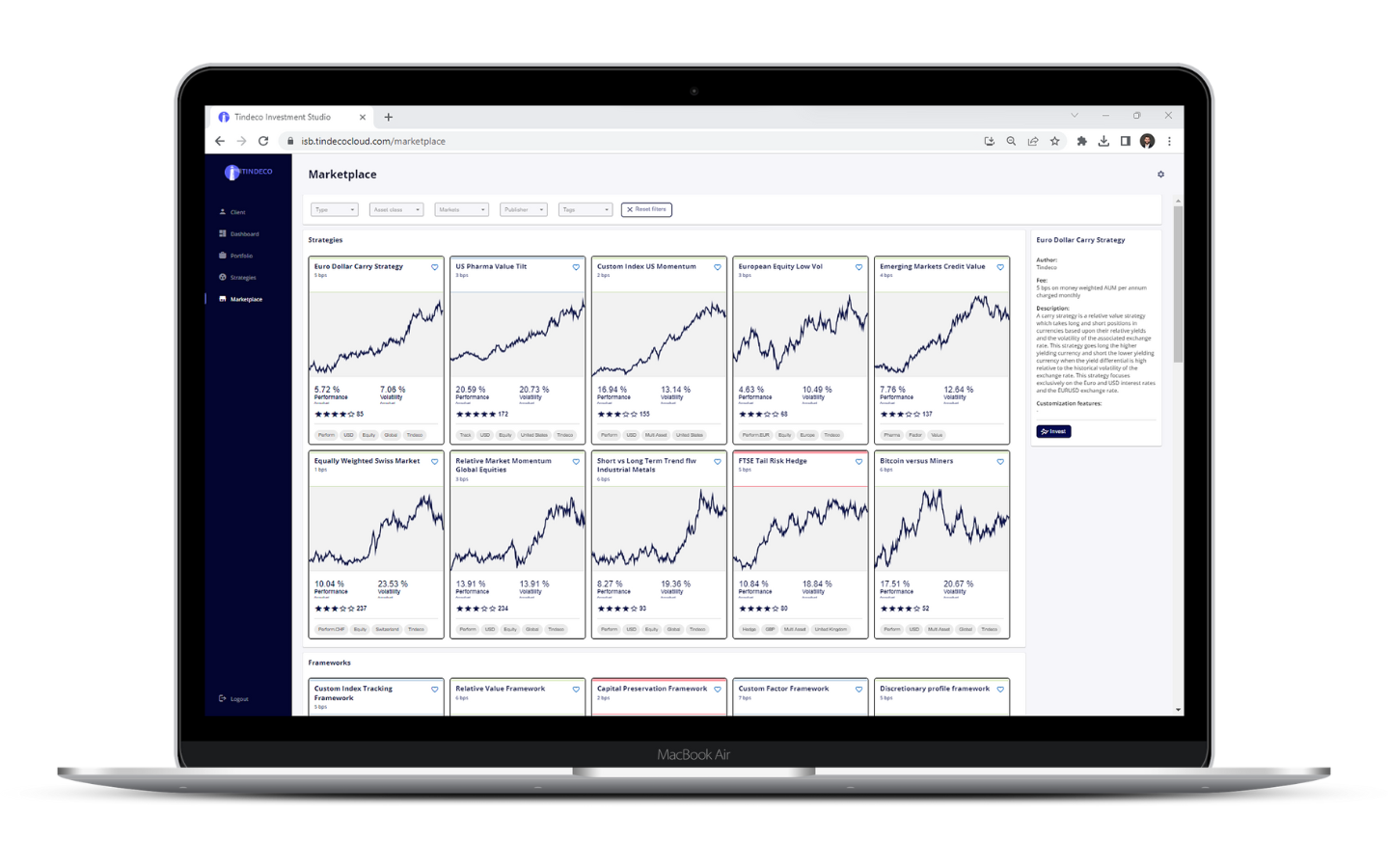

Marketplace

Select and customize a strategy to manage your portfolios or publish your own strategy to the Marketplace

-or-

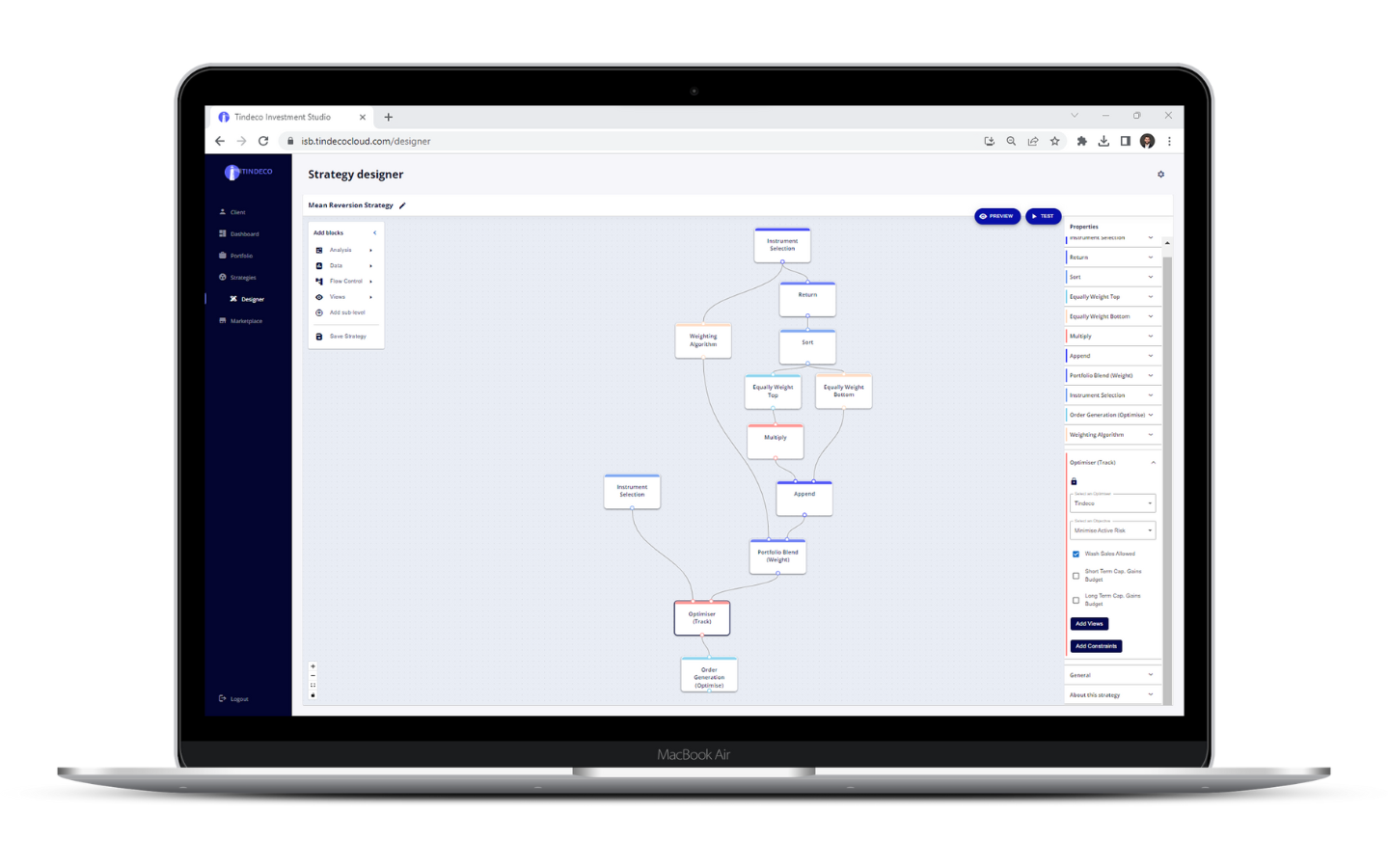

Strategy Designer

Design a custom strategy in minutes using our revolutionary No-Code designer

Marketplace

What’s more, you can configure these strategies to create custom portfolios with:

- Custom permissible asset universe (e.g. ESG filters, block allow list)

- Custom rebalancing criteria (e.g. tracking error, compliance breach)

- The ability to intelligently combine strategies for holistic solutions

- Multi-strategy and building block solutions

Strategy Designer

- A wide range of analytics are available (e.g. risk, optimization, simulation, statistical models)

- In-house views and algorithms can be easily incorporated to leverage your CIO, analyst and quant capabilities

- Our robust partner ecosystem provides a wide array of resources that you can use to create and manage your strategies”

Benefits

Orchestration

Our Strategy Designer acts as an orchestration layer allowing you to combine resources like data, algorithms, model portfolios and optimization engines to rapidly design customizable investment strategies.

Customizations

The Studio lets you decide exactly how much customization to offer your clients.

No-Code Design

There’s no need to write code with our drag and drop interface. It supports you in designing systematic investment strategies based on power analytics and logic in minutes.

FAQs

What fees does Tindeco Charge?

Tindeco charges based upon the assets being managed using strategies developed in the Studio and / or offered in the Marketplace. Fees vary with the complexity of the strategy as well as the partner content which is utilized. Minimum fees apply.

Do I need a specific portfolio management system?

You do not need a specific PMS. Tindeco is integrated with a variety of third party portfolio and order management systems. Our advanced integration capabilities lets us integrate with the systems you are using today.

How can my end clients influence what is in their portfolios?

You decide what degree of customization to offer your clients. In our experience, private clients tend to have relatively simple desires related to inclusion / exclusion criteria, risk tolerances (capital preservation and drawdown targets) and their ethical beliefs. Institutional clients are more likely to have custom requirements based on tracking error, risk allocations and turnover. Tindeco enables you to offer precisely the degree of customization that you target for each of your clients.

How long does it take to get started?

It’s easy to get started with Tindeco. Our systems have advanced data exchange capabilities and are integrated with a wide variety of PMS, OMS and brokerage platforms.